Wv Labor Laws How Many Continuous Days Can I Work

West Virginia Labor Laws Guide

Ultimate West Virginia labor law guide: minimum wage, overtime, break, leave, hiring, termination, and miscellaneous labor laws.

| West Virginia Labor Laws FAQ | |

| West Virginia minimum wage | $8.75 (see below for exceptions) |

| West Virginia overtime | 1.5 times the regular wage for any time worked over 40 hours/week ($13.1 for minimum wage workers) (see below for exceptions) |

| West Virginia breaks | 20-minute breaks for each shift exceeding 6 hours |

Table of contents

- West Virginia Wage Laws

- West Virginia Payment Laws

- West Virginia Overtime Laws

- West Virginia Break Laws

- West Virginia Leave Requirements

- Child Labor Laws In West Virginia

- West Virginia Hiring Laws

- West Virginia Termination Laws

- Occupational Safety In West Virginia

- Miscellaneous West Virginia Labor Laws

West Virginia wage laws

The state of West Virginia has its own laws for handling minimum wages regarding different groups of employees.

The following are wage regulations concerning:

- State minimum wage,

- Tipped hourly wage, and

- Subminimum wage in West Virginia.

| WEST VIRGINIA MINIMUM WAGE | ||

| Regular minimum wage | Tipped minimum wage | Subminimum wage |

| $8.75 | $2.62 | $6.40 |

West Virginia minimum wage

West Virginia employers must pay their employees a minimum wage of $8.75 per hour

However, such wage only applies to separate, distinct, and permanent work locations (including remote work) with 6 or more non-exempt employees.

In case the 6-employee requirement is not met — the federal minimum wage of $7.25 per hour applies.

Exceptions to the minimum wage in West Virginia

Employees who are exempt from the minimum wage requirement in West Virginia are the following:

- Volunteers or individuals who are engaged in educational, charitable, religious, fraternal, or nonprofit organizations

- Newsboys, shoeshine boys, golf caddies, pin boys, and pin chasers in bowling lanes

- Traveling and outside salesmen

- Individuals employed by their parent, son, daughter, or spouse

- Bona fide professional, executive, or administrative employees

- On-the-job trainees

- Persons with physical or mental impairment

- Boys or girls summer camp employees

- Individuals 62 years of age or older who received old-age or survivors benefits from the Social Security Administration

- Agricultural workers

- Firefighters employed by state or agency

- Ushers in theaters

- Students employed in a school or college as part-time workers

- Individuals employed by a local or interurban motorbus carrier

- Salesmen, parts men, or mechanics engaged in selling or servicing (but not manufacturing) automobiles, trailers, trucks, farm implements, or aircraft

- Employees whose qualifications and maximum hours of service are established by the United States Department of Transportation

- Individuals employed on a per diem basis by the Senate, the House of Delegates, or the Joint Committee on Government and Finance of the Legislature of West Virginia, other employees of the Senate or House of Delegates designated by the presiding officer thereof, and employees of the Joint Committee on Government and Finance designated by such joint committee

- Seasonal employees of a commercial whitewater outfitter and amusement parks who work less than 7 months in a calendar year

Tipped minimum wage in West Virginia

West Virginia employers are allowed to take a credit of 70% against the state minimum wage requirement for service employees* who customarily receive tips or gratuities.

Therefore, tipped employees in West Virginia are entitled to at least $2.62 per hour of work.

Still, the tipped employee's hourly wage — when wages and tips combine — must equal the state minimum wage of $8.75 per hour to meet the minimum wage requirement.

In case it does not, the employer is required to pay the difference.

However, if a service employee performs duties for which they do not receive tips for more than 20% of their time at work — e.g. cleaning tables, making coffee, and the like — the employer shall pay such employee $8.75 per hour, without taking a tip credit.

*In West Virginia, dual job employees — i.e. those who perform work as both tipped and non-tipped employees — also qualify for the West Virginia tipped minimum wage. Still, when taking a credit against the minimum wage for a dual employee, the employer must have records that show the exact number of hours worked by such employee.

West Virginia subminimum wage

Subminimum wage allows employers to pay certain employees a wage that is less than the standard minimum wage.

In West Virginia, workers 20 years of age or younger are entitled to a training wage that is less than the standard minimum wage — $6.40 per hour.

Yet, this remains valid only during their first 90 days of employment, after which they are entitled to the standard minimum wage of $8.75 per hour.

West Virginia payment laws

West Virginia employers are required to pay their employees at least twice a month and with no more than 19 days between paydays.

But, the Commissioner of Labor may grant a special agreement to the employer that allows them to pay their workers less than twice a month.

Workers should call (304)558-7890 to find out if their employer has been issued such a special agreement.

Furthermore, West Virginia railroad companies are allowed to pay their employees:

- On or before the 1st day of each month for the wages earned during the first half of the preceding month, and

- On or before the 15th day of each month for the wages earned during the last half of the preceding month.

West Virginia overtime laws

In West Virginia, certain requirements must be met for the state overtime provisions to apply:

- The company must not be eligible for federal "enterprise" coverage.

- 80% of the company's workforce must not qualify individually for overtime pay under the Fair Labor Standards Act (FLSA).

- The company must meet the 6-employee requirement.

Therefore, eligible employees are entitled to overtime pay at a rate of one and a half (1.5) times the regular rate.

Piece workers overtime rate

Piece workers — i.e., employees who are paid for each unit produced or action performed — also qualify for overtime pay under West Virginia law.

Employees with several jobs overtime rate

Employees who perform two or more jobs receive overtime pay — but such overtime pay is calculated in the following manner:

For example, an employee is paid $9 per hour for working at a restaurant and $11 per hour for working at a souvenir shop.

The employee's total working hours for the week is 43 — he works 35 hours at the restaurant and 8 hours at the shop.

Since the employee worked in excess of 3 hours in that souvenir shop, his overtime rate would be based on $11 per hour.

Track West Virginia overtime with ClockifyOvertime exceptions and exemptions in West Virginia

Under state law of West Virginia, the following employees are exempt from overtime pay:

- United States Government employees

- Educational, charitable, religious, fraternal, or non-profit organization volunteers

- Newsboys, shoeshine boys, gold caddies, pin-boys, and pin chasers in bowling alleys

- Traveling and outside salesmen

- Individuals employed by their parent, son, daughter, or spouse

- Bona fide professional, executive, or administrative employees

- On-the-job trainees

- Handicapped individuals working in a nonprofit sheltered workshop

- Boys or girls summer camp employees

- Individuals 62 years of age or older who receive social security benefits

- Agricultural workers

- Firefighters employed by state

- Ushers in theaters

- Students working 24 hours or less per week

- Individuals employed by a local interurban motorbus carrier

- Employees under Federal Department of Transportation (DOT) regulations

- Individuals employed on a per diem basis by the West Virginia State Senate, the House of Delegates, or the Joint Committee on Government and Finance

- Salesmen, parts men, or mechanics engaged in selling or servicing (but not manufacturing) automobiles, trailers, trucks, farm implements, or aircraft

- Individuals employed as seasonal employees of a commercial whitewater outfitter and amusement park workers who work less than 7 months in a calendar year

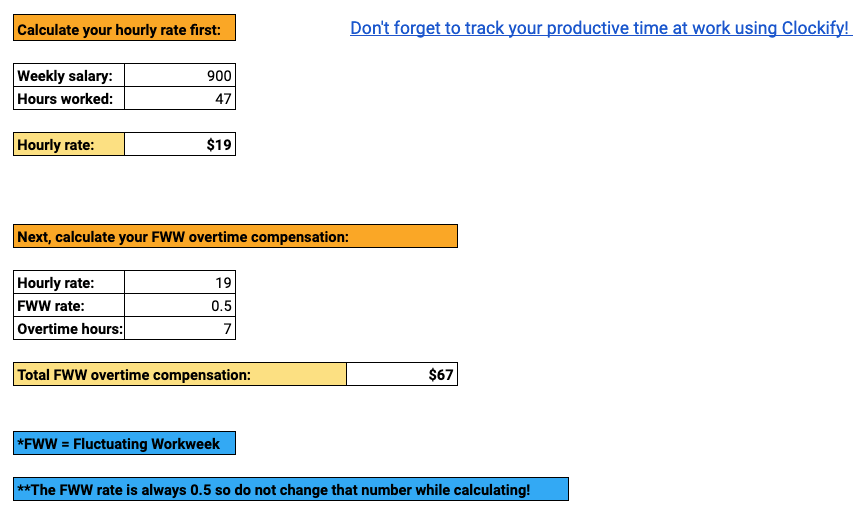

Fluctuating Workweek Method (FWW) in West Virginia

Under the Fluctuating Workweek Method, salaried employees — who are considered as exempt employees — are also eligible for overtime pay.

Apart from the fixed salary requirement, other conditions must also be met for the FWW to apply:

- The employee's work hours must fluctuate from week to week — i.e. sometimes they work more or less than 40 hours a week.

- The employee's minimum hourly wage must be at least $7.25 per hour.

When the said conditions are met, eligible employees are entitled to overtime pay of one-half (0.5) times the regular hourly rate.

Fluctuating Workweek Calculator

Fluctuating Workweek Calculator Let's see how the Fluctuating Workweek Method (FWW) works in practice:

An employee's weekly income is, for instance, $850.

In the preceding week, the employee worked 46 hours.

To be able to calculate overtime hours, calculate the hourly rate first.

Simply divide the weekly salary by the number of hours worked for that week.

$850 / 46 = $19 per hour

Next, multiply the hourly rate by 0.5 for every overtime hour during a week.

$19 per hour x 0.5 = $9.5 for each overtime hour worked

Total overtime compensation goes as follows:

$9.5 x 6 overtime hours = $57

How to manage working 80+ hours a weekWest Virginia break laws

In West Virginia, if an employee works 6 or more hours a day, they are entitled to a paid meal break of at least 20 minutes.

Employers are advised to provide breaks to their employees as they may reduce stress, improve employee productivity, and prevent burnout.

Exceptions to break laws in West Virginia

The said provisions, however, do not apply to workers who are allowed to eat while working. They are not eligible for paid meal breaks.

Furthermore, any break lasting 30 minutes or longer is not treated as work time and hence is not compensated.

Simplest way to set up an employee clock-in/clock-out systemWest Virginia breastfeeding laws in the workplace

Regarding breastfeeding breaks in the workplace, West Virginia employers must comply with federal regulations.

Under federal law, employers must provide a breastfeeding mother:

- A reasonable break time without pay to breastfeed or express milk in the workplace for 1 year after the child's birth,

- A breastfeeding break whenever a mother needs to breastfeed or express milk in the workplace, and

- A separate room (other than a restroom) for the purpose of breastfeeding or expressing milk.

Yet, not all employees qualify for such breaks. Under federal breastfeeding law, only businesses with more than 50 nonexempt employees are covered.

West Virginia leave requirements

The state of West Virginia regulates the provisions and conditions for obtaining leaves of absence.

There are two types of leaves:

- Required leave

- Non-required leave

West Virginia required leave

The following are instances when employers are required to provide their employees with days off.

Here is the list of required leaves of absence in West Virginia:

- Sick leave (public employers)

- Parental leave

- Family and Medical Leave Act (FMLA)

- Holiday leave (public employers)

- Annual/vacation leave (public employers)

- Military leave (public employers)

- Donor leave (public employers)

- Disaster service volunteers leave (public employers)

Sick leave (public employers)

State employees start accruing sick leave from the first day of state employment — 1.5 days per month or 18 days per year.

Sick leave may be used in case of:

- Illness

- Injury

- Medical appointments

- Death in the immediate family (up to 3 days)

What's more, state employees may use up to 80 hours of sick leave when their immediate family members are ill, injured, or have medical appointments.

Parental leave

Employees of all departments, divisions, boards, bureaus, agencies, commissions, or other units of State Government and County Boards of Education are entitled to 12 weeks of unpaid leave during any 12-month period.

Eligible employees may use parental leave in the following circumstances:

- Birth of a newborn child

- Placement for adoption

- Caring for an immediate family member (child, spouse, parent, or dependent) due to a serious health condition

Parental leave may be used only after exhausting the employee's annual and personal leave.

Family and Medical Leave Act (FMLA)

The Family and Medical Leave Act (FMLA) is a federal law that offers additional leave to eligible employees for certain family or medical reasons.

On that account, eligible employees may receive up to 12 weeks of job-protected leave a year, provided that they have worked for their employer for at least 12 months (1,250 hours) in the last 12-month period.

Such leave is not compensated — but it covers the following individuals:

- Public agency employees (provided there are more than 50 employees employed)

- Public and private elementary or secondary school employees

What are the FMLA qualifying events?

Eligible employees may take the FMLA leave in the following events:

- Birth or care for a newborn child

- Adopting or taking in a foster child

- Caring for an immediate family member (child, spouse, or parent) due to a serious health condition

- The employee having a serious health condition

- Employee's spouse, child, or parent being on active duty

What's more, eligible employees may take up to 26 workweeks of the FMLA leave in case they need to take care of a service member — either their spouse, child, parent, or next of kin — following any serious health condition due to them being members of the military.

Holiday leave (public employers)

West Virginia state employees get 12 paid holidays per year.

The following are official state holidays of West Virginia:

- New Year's Day (1st of January)

- Martin Luther King Day (third Monday in January)

- Presidents' Day (third Monday in February)

- Memorial Day (last Monday in May)

- West Virginia Day (20th of June)

- Independence Day (4th of July)

- Labor Day (first Monday in September)

- Columbus Day (second Monday in October)

- Veterans Day (11th of November)

- Thanksgiving Day (fourth Thursday in November)

- Day After Thanksgiving (fourth Friday in November)

- Christmas Day (25th of December)*

* If Christmas Day and New Year's Day fall on either Tuesday, Wednesday, Thursday, or Friday, the preceding day — Christmas Eve or New Year's Eve — is considered time off. Yet, eligible employees do not receive the whole day off but only half — not to exceed 4 hours.

Other occurrences when eligible employees are given time off in West Virginia include:

- Primary and General election days

- Any other day when the President, Governor, or other duly constituted authority issues a proclamation of a holiday, days of special observance, thanksgiving, or days for the general cessation of business

Finally, if a holiday falls on a Saturday, the preceding Friday shall be considered as a day off, and if it falls on a Sunday, the following Monday shall be a day off.

Annual/vacation leave (public employers)

Annual leave refers to personal time off that eligible employees start accruing from the first day of state employment.

The following is the annual leave accrual schedule:

| Years of service | Accrual rate (earned days monthly and yearly) | Maximum yearly carryover amount |

| Less than 5 | 1.25 monthly / 15 yearly | 30 days |

| 5 but less than 10 | 1.50 monthly / 18 yearly | 30 days |

| 0 but less than 15 | 1.75 monthly / 21 yearly | 35 days |

| 15 or more | 2.00 monthly / 24 yearly | 40 days |

Jury, court, and hearing leave (public employers)

West Virginia state employees must be excused from work when called to serve as a juror or witness before any court, board, or other lawfully authorized body. Such leave is paid.

Military leave (public employers)

State employees of West Virginia are entitled to 60 days (480 hours) of military leave with pay.

Eligible employees include:

- National Guard members or any federal armed service reserve members (up to 30 days)

- Employees called or ordered to active duty by federal authority (additional 30 days)

If an employee must prolong their absence from work longer than the 60-day limit, they may start using their annual leave with pay or personal leave without pay (which must first be requested and approved).

Donor leave (public employers)

Full-time state employees are eligible for donation leave which includes:

- Up to 120 hours of paid leave for donating any portion of adult liver or kidney

- Up to 56 hours of paid leave for donating adult bone marrow

Disaster service volunteers leave (public employers)

Certified service volunteers of the American Red Cross — state employees — are granted paid leave of absence of up to 15 work days each year to participate in disaster relief services.

West Virginia non-required leave

No federal or state law that obliges an employer to provide a leave of absence for hours not worked. This predominantly concerns private employers, and most of the leave benefits with regard to private employment are left to the discretion of the employer.

That said, West Virginia private employers do not have to provide their employees time off in the following events:

- Sick leave

- Holiday leave

- Annual/vacation leave

- Military leave

- Donor leave

- Disaster service volunteers leave

Child labor laws in West Virginia

In the state of West Virginia, minors aged 14 through 17 are allowed to work — but employers must keep in mind the strict provisions of state child labor laws.

However, when employing minors aged 14 and 15 (provided that is a permissible occupation), the employer must obtain a work permit. This, however, does not apply to family-owned businesses when employing their own children.

Child labor laws support minors to start developing working habits at an early age — but, at the same time, make sure they work in a healthy and hazard-free environment.

The following are child labor provisions in West Virginia regarding:

- Hour restrictions

- Break periods

- Prohibited occupations

Work time restrictions for West Virginia minors

West Virginia employers who wish to employ minors aged 14 and 15 must comply with the following hour regulations:

- Time restrictions for minors aged 14 and 15 when school is IN session:

- May not work before 7 a.m. or after 7 p.m.

- May work up to 3 hours per day

- May work a total of 18 hours per week

- May not work during school hours (unless participating in a school-supervised work experience program or school-administered WECEP program)

- Time restrictions for minors aged 14 and 15 when school is NOT in session:

- May not work before 7 a.m. or after 9 p.m.

- May work up to 8 hours per day

- May work up to 40 hours per week

There are no hour limitations when it comes to the employment of minors aged 16 or 17.

However, a prospective employer is accountable for obtaining the Division's age certificate form as proof of the minor's age.

Breaks for West Virginia minors

Employers must ensure that their employees who are minors get at least a 30-minute meal break after every 5 hours of work.

Prohibited occupations for West Virginia minors

The following occupations are identified as hazardous by the West Virginia Division of Labor and federal law, and they apply to all minors under the age of 18.

West Virginia hazardous occupations and duties for minors under the age of 18:

- Manufacturing or storing explosives (but not working in retail stores selling gun shots and ammunition, skeet ranges, and police stations)

- Driving a motor vehicle or working as an outside helper on a motor vehicle (but 17-year-olds may drive cars or small trucks during daylight and under other relevant limitations)

- Coal mining

- Forest fire fighting and prevention, timber tract, forestry service, logging, and sawmilling operations

- Operating power-driven woodworking machines such as chain saws, nailing machines, and sanders

- Working near radioactive substances and ionizing radiation

- Operating, riding on, and assisting in the operation of power-driven hoisting apparatus such as forklifts, skid-steers and loaders, cranes (not valid for chair-lifts at ski resorts or electric and pneumatic lifts used to raise cars in garages or gasoline service stations)

- Operating power-driven metal-forming, punching, and shearing machines

- Mining (not valid for mining coal)

- Operating power-driven meat-processing machines such as saws, meat slicers (includes cleaning such machines)

- Performing meat and poultry slaughtering, processing, rendering, or packing

- Operating power-driven bakery machines such as batter mixers or cookie machines (however, 16 and 17-year-olds may use certain countertop mixers and pizza dough rollers)

- Operating compactors, balers, power-driven paper products machines such as printing presses and envelope die cutting presses (however, 16 and 17-year-olds may load certain scrap paper balers and paper box compactors)

- Manufacturing brick, tile, and related products

- Operating power-driven circular saws, band saws, guillotine shears, chain saws, reciprocating saws, wood chippers, and abrasive cutting discs

- Wrecking, demoliting, and ship-breaking operations (except remodeling or repair work which is not extensive)

- Roofing operations

- Trenching and excavation operations

Volunteer firefighter exception for minors aged 16 and 17

Minors aged 16 and 17 are allowed to serve as junior volunteer firefighters — but only after meeting the following requirements:

- Must complete the minimum training requirements of the West Virginia University Fire Service Extension Junior Firefighter Training (or an equivalent approved program — such as the West Virginia State Fire Commission program) and provide proof of its successful completion

- Must obtain the written consent of a parent or guardian

- Must obtain an age certificate from the school

- Must be under the direct supervision and control of authorized fire protection personnel

- May not drive any fire apparatus, ambulance, or similar apparatus

- May not operate flashing lights, a siren, or other audible signal in a vehicle

- May not operate or climb an aerial ladder, platform, or hydraulic jack at a fire scene

- May not use rubber electrical gloves, insulated wire gloves or cutters, life nets, acetylene cutting units, K-12 saws, air chisels, jaws of life, or other rescue or fire-related equipment

- May not operate the pumps or high-pressure hoses

- May not enter a burning structure

Therefore, as long as a minor wears protective equipment, they may participate in training activities, administer first-aid, clean up the outside area of a fire or emergency scene, and provide coffee and food at the scene.

West Virginia hiring laws

Under the West Virginia Human Rights Act, all employees must be given equal opportunity for employment without regard to:

- Race

- Religion

- Color

- National origin

- Ancestry

- Sex

- Age

- Blindness

- Disability

Therefore, it is considered an unlawful discriminatory practice for any employer, employment agency, labor organization, or joint labor-management committee controlling apprentice training program to:

- Discriminate against an individual in terms of hiring (i.e. fail or refuse to hire, classify, refer for employment), compensation, conditions, or privileges of employment based on race, religion, color, etc.

- Elicit information or use any form of application containing questions with regard to race, religion, color, national origin, ancestry, sex, or age for the purpose of employment or membership.

- Print or publish any notice or advertisement that show preference, limitation, or discrimination based on race, religion, color, national origin, ancestry, sex, disability, or age for the purpose of employment or membership.

- Deny equal membership rights or select individuals for an apprentice training program, guidance program, on-the-job training program, and similar programs, based on their race, religion, color, etc.

- Threat, conspire with others to harass, degrade, or cause physical harm or economic loss to any person.

Still, employers can show preference when hiring a veteran or disabled veteran — provided that the veteran or disabled veteran meets all the job-related requirements.

Any individual who suffers damages based on the said discriminatory practices has the right to file a complaint within 365 days of the alleged violation to the commission.

Right-to-work law in West Virginia

West Virginia was one of the last states to adopt the right-to-work law (RTW law).

As of July 1, 2016, West Virginia workers may decide whether or not to join or financially support a labor union. Before this law came into effect, workers could be forced to pay fees to a labor union as a condition of employment.

The right-to-work law of West Virginia applies to most workers — but excludes:

- Federal employees

- Airlines or railroad employees*

- Employees working on property subject to exclusive federal jurisdiction*

*Such employees may not be conditioned to join a union — but may be required to pay union fees as a condition of employment.

What's more, the RTW law of West Virginia only applies to collective bargaining contracts that were formed, modified, renewed, or extended after July 1, 2016.

Voluntary union members, however, may send a request to the union and employer to resign from the union. Private-sector employees may resign at any time.

No employer shall discriminate against any employee who joins or does not join a labor union in terms of employment, benefits, etc. Moreover, union members who work during a strike may be subject to fines by the labor union.

West Virginia termination laws

As in many other states, West Virginia has adopted the at-will-employment law. This means that an employer may terminate an employee at any time and for any reason or no reason at all.

The same applies to employees — they may rightfully quit their jobs at any time, with or without cause.

Still, no employer may terminate an employee based on discriminatory bias. Such termination is called "wrongful termination" and employers must not end the employment based on the employee's:

- Race

- Religion

- Color

- National origin

- Ancestry

- Sex

- Age

- Blindness

- Disability

- HIV/AIDS status

West Virginia final paycheck

There are different requirements regarding the payment of final wages in West Virginia. The rules depend on the circumstances of how the employment ended.

Reasons for separation of employment in West Virginia:

- Quit/resigned/terminated/fired — Final wages must be paid on or before the next regularly scheduled payday

- Lay off — On the next regularly scheduled payday

Health insurance continuation in West Virginia

Terminated employees and their dependents in West Virginia have the right to continue their Public Employees Insurance Agency (PEIA) health benefits under the Consolidated Omnibus Budget Reconciliation Act (COBRA). PEIA is a group health benefit plan that is covered by federal COBRA law.

Therefore, all eligible employees using such health plans may continue their health insurance benefits for 18 to 36 months after the separation of employment.

The duration of the health coverage depends on the "qualifying event" — and the following are qualifying events for employees and their dependents:

- 18-month coverage for employees — In case of voluntary or involuntary termination (except when the termination was a result of gross misconduct), and work-hour reduction.

- 36-month coverage for spouses — In case of death of a spouse, divorce or legal separation, or when electing the Medicare health plan.

- 18-month coverage for spouses — In case of spouse's voluntary or involuntary employment separation (except when the separation was a result of gross misconduct), and reduction in spouse's work hours.

- 36-month coverage for dependent children — In case of parent's death, parent's election of Medicare, divorce of parents, or ineligibility to meet the requirements of a dependent child.

- 18-month coverage for dependent children — In case of a parent's voluntary or involuntary employment separation (except when the separation was a result of gross misconduct), or reduction in parent's work hours.

Who is eligible for PEIA coverage under COBRA?

Eligible employees (and their dependents) include:

- Permanent full-time employees of West Virginia

- County boards of education, counties, cities, or towns

- Individuals of government bodies

- Long-term substitute teachers and school service personnel

- Legal spouse, biological or adopted child and stepchildren under 26 years of age

- Children of court-appointed guardians under the age of 18

Occupational safety in West Virginia

When it comes to establishing a safe and hazard-free work environment — both federal and state provisions of West Virginia apply.

Federal OSHA program

Under the federal Occupational Safety and Health Administration (OSHA), private employers are responsible for providing their employees with a healthy and safe workplace.

What's more, OSHA induces education and training with the intention of reducing work-related injuries and fatalities.

There are 6 main types of hazards in the workplace recognized by OSHA:

- Biological hazards — Mold, pests, insects, etc.

- Chemical and dust hazards — Pesticides, asbestos, etc.

- Work organization hazards — Things that cause stress such as excessive workload, workplace violence, etc.

- Safety hazards — Slips, trips, falls, etc.

- Physical hazards — Noise, radiation, temperature extremes, etc.

- Ergonomic hazards — Repetition, lifting, awkward postures, etc.

West Virginia Occupational Safety and Health Act

Each public employer in West Virginia must comply with occupational safety and health standards under this act — to create a hazard-free workplace and promote a strong safety culture.

To make sure such standards are met, during work hours, the commissioner is authorized to enter premises — without prior notice — to inspect a place of employment including all conditions, apparatus, equipment, and similar.

Furthermore, employers are obligated to keep their employees educated and informed of the provisions and safety measures under this act.

Anyone who believes there has been a violation of a health or safety standard is responsible for notifying the commissioner in writing — without later being discriminated against in any manner.

OSHA offices in West VirginiaMiscellaneous Texas labor laws

In the miscellaneous section, we will cover the following labor laws:

- Whistleblower laws

- Recordkeeping laws

West Virginia whistleblower laws

In accordance with the West Virginia Whistleblower Law, public employees are protected from employment discrimination, discharge, or retaliation if such employees, acting in good faith, report any:

- Waste — If an employer or employee causes any damage, abuse, or loss of federal, state, or political subdivision funds or resources.

- Wrongdoing — This includes any non-technical violations of any statute, regulation, ordinance, or code of ethics.

On that account, no employer may:

- Discharge, threaten, retaliate or discriminate against an employee who reports any of the said violations. This includes discriminating in compensation, terms, conditions, location, or privileges of employment when an employee reports an instance of waste or wrongdoing.

- Discharge, threaten, retaliate, or discriminate against an employee who was called to participate in an investigation, hearing, or inquiry held by a court or appropriate authority.

- Deny an employee who "blows the whistle" — i.e. reports a violation — a promotion or increase in compensation for making a good faith report.

Anyone who believes there has been a violation of federal, state, or political subdivision statute, regulation, ordinance, or code of ethics is obliged to contact the appropriate supervisory personnel in their office, agency, or other appropriate official.

West Virginia recordkeeping laws

Concerning the preservation of personnel records in West Virginia, every employer — including the state of West Virginia, its agencies, departments, political subdivisions, and any individual, partnership, association, a public or private corporation with 6 or more employees — must keep written records at the place of employment for at least 2 years.

Said employers shall keep and preserve the following records:

- Name and address of each employee

- Employee's rate of pay

- Employee's total hours of employment

- Payroll deductions

- Amount paid to each employee for each pay period

Conclusion/Disclaimer

We hope this West Virginia labor law guide has been helpful. We advise you to make sure you've paid attention to the links we've provided, as most of them will lead you to the official government websites and other relevant information.

Please note that this guide was written in Q3 2022, so any changes in the labor laws that were included later than that may not be included in this West Virginia labor laws guide.

We strongly advise you to consult with the appropriate institutions and/or certified representatives before acting on any legal matters.

Clockify is not responsible for any losses or risks incurred, should this guide be used without further guidance from legal or tax advisors.

Need a simple time clock for employees?

Clockify allows you to track time, attendance, and costs with just a few clicks, for FREE.

Your team can track work time via web or mobile app personally, or you can set up a time clock kiosk from which employees can clock in and out.

Later, you can approve timesheets and time off, schedule shifts, run time card reports, and export everything for payroll (PDF, Excel, link, or send to QuickBooks).

See all features

Get started for FREE

Source: https://clockify.me/state-labor-laws/west-virginia-labor-law

0 Response to "Wv Labor Laws How Many Continuous Days Can I Work"

Post a Comment